The biggest questions regarding my financial future and retirement have been how will I afford this lifestyle and what do I leave to my spouse and kids. Selfishly, I admit that the first question held a much higher priority for me than the second question. At the time, I had no idea how to go about predicting that. My first naive attempt was to build a spreadsheet with all of my assets, pension, and social security estimates and run down my withdrawals until my expected demise or the assets ran out. I assumed some baseline growth in my assets and portfolio based on historical averages, inflation, cost of living increases and the like. I then built what I thought was a complex model to run it all out to the end. A little research into such an approach quickly revealed that I was an idiot.

Now admittedly in a perfect world where all systems behave on the average, I was indeed correct in my modeling and analysis. The part that I neglected to consider were the historical variation in stock prices, variances in inflation, inevitable stock market crashes, sudden needs for emergency cash, and the list goes on. I quickly realized that the correct model needed to be based on probabilities and statistics using historical probabilities and statistics.

What’s that you talkin’ bout Willis? Well, lemme tell ya. There are a couple of hundred years of data out there regarding how different categories of stocks have behaved throughout history. On top of that, there are modeling techniques that can be used to reflect those behaviors and provide one with a probability of successfully running the gauntlet of life and leaving a few bucks for your kids to blow on golf and beer. So let me discuss the two that I found to be fruitful and that now provide me with a good nights sleep. The modeling tools that I ended up using are built upon a technique called “Monte Carlo Simulation”. The textbook definition is below

Monte Carlo simulation performs risk analysis by building models of possible results by substituting a range of values—a probability distribution—for any factor that has inherent uncertainty. It then calculates results over and over, each time using a different set of random values from the probability functions.

Investopedia

Each asset class (e.g. small cap, large cap, etc) has an inherent risk and probability distribution associated with it. A Monte Carlo simulation allows us to determine the size and asset classes within the portfolio we would need at retirement to support our desired retirement lifestyle and other desired gifts and bequests. The result is a distribution of portfolio sizes with the probabilities of supporting our desired spending needs.

If all of this mathematical mumbo jumbo is making your head spin, no worries, as there are free tools available that can perform these simulations with a modicum of pain. You just need to enter your asset data or provide a feed of your asset data from some source e.g. Schwab, your bank, Ameritrade, your employer, yada yada.

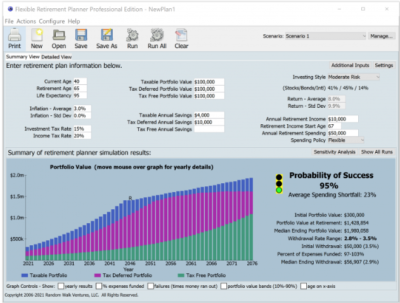

The first tool that I tried was called the “Flexible Retirement Planner”. With this tool, you need to enter your age, retirement age, portfolio values, risk tolerance, yearly spending, yearly savings, etc as seen in the example below. You can even enter your social security estimates and pension payments, should you have one. The tool will then run thousands of simulations using Monte Carlo against historical stock market data and give you a probability of success. The tool is free and well constructed, and I think gives you good results at a fairly rough granularity. Obviously the numbers are a bit granular since you really don’t give any information about your actual portfolio, just your risk tolerance. High risk would be all stocks and low risk would be all bonds. All stocks would have more probability of bigger gains, but also more likelihood of volatility. Nevertheless, i was initially very happy with this tool. The Flexible Retirement Planner can be found here – https://www.flexibleretirementplanner.com/wp/

When I first started looking at tools to track my finances, I did use a tool called Mint from Intuit which can be found here – https://mint.intuit.com. It is very good on the budgeting side of the equation, and not so good on the retirement planning side. I used it for a few years until I found other tools that did a better job at retirement planning. A tool called Personal Capital proved to more closely match my needs and is discussed in detail below. Mint and Personal capital work similarly in that they both connect to your accounts and track finances in real time. Mint also has a much larger user base, as it has been around for a much longer time. Mint was originally owned by Microsoft, until Intuit bought it from them in 2009. I haven’t used Mint in many years and it may have improved its retirement planning capabilities. It may be worth your while to investigate it, if you are more comfortable with a tool owned by a company like Intuit.

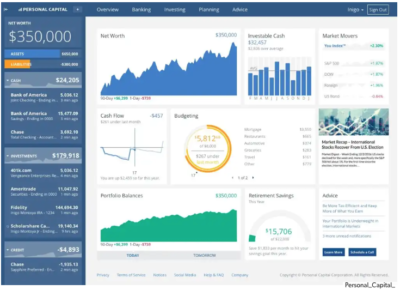

The tool that I currently use is called Personal Capital and is located here https://www.personalcapital.com/. This tool is also free, but the company will try to sell you on their wealth advisory services. They called me a few times, and I did talk to them, but decided to go it on my own. I’ve been using the tool now for a few years with no issue and am very happy with the results. I also got rid of Quicken as my spending tracker and now use the data from Personal Capital to track all of my expenses and to do my taxes. It is currently an indispensable tool for me in my financial journey. So how does it work?

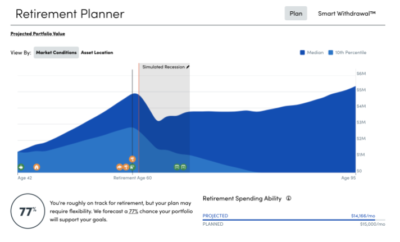

After you sign up for an account, you can connect each of your financial, bank, and credit card accounts to the tool so that you can have real time tracking of all of your expenses and finances. That access is read only and the tool has great security with two factor authentication. They currently have about 2 million users and are very well respected. The tool tracks your expenses and savings and also provides tools to budget and perform Monte Carlo simulations of your retirement strategy using the actual data from your accounts. Similar to the Flexible Retirement Planner, you can also enter your social security estimates and pension, as well as any upcoming major expenses that you might be planning. You can also create alternative scenarios so that you can compare the impact of say, buying that yacht or second home in the Caribbean. An example Dashboard and Monte Carlo simulation output are below.

As always, take all of this information with the caveat that I am not a financial planner. Just a guy with a family, sailing through life on a journey of discovery. My advice to you is to start with the Free Retirement Planner and get comfortable with Monte Carlo simulations. At the very least, you’ll get a sense as to whether you are sailing, sinking, or headed towards an ice berg.